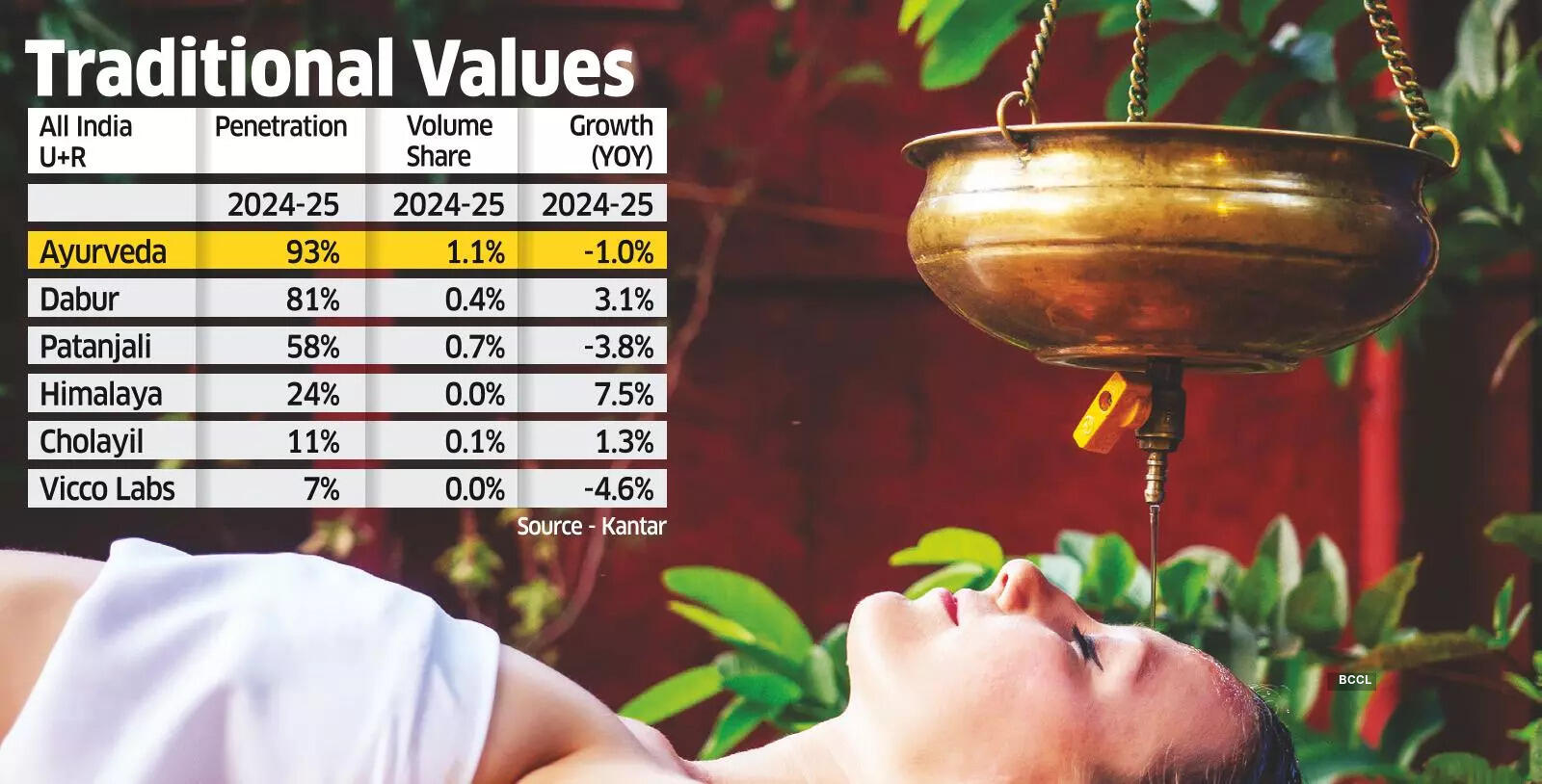

The Ayurveda, the traditional health system of India, represents just over 1% of the overall market of rapid movement goods (FMCG) despite the leading companies have launched hundreds of natural personal care products and based on herbs in recent years.While 92% of Indian families purchased Ayurvedic products in 2024-25 compared to 89% five years ago, the contribution of the segment to the total volume of FMCG increased to 1.1% from 0.8% during the period, according to a new exclusive report of Kantar, the consumption arm consumption of WPP.

In addition, in 2024-25, sales of Ayurvedic products in volume decreased by 1% on an annual basis, its first decline ever, a strong inversion with a high two-digit growth in recent years at the hand of the meteoric ascent of Patanjali, a brand based on Ayurveda from the Guru of Yoga Baba Ramdev and from Covid-199 by natural products.

“The Ayurvedic brands grew up during the pandemic while consumers focused on immunity. But most brands speak of natural ingredients and not many companies speak of Ayurveda. In the year 24, Patanjali led the growth of the category and in Fy25, their performance dragged the south number. Worldpanel division. “While not falling under the traditional FMCG bracket, products with ingredients such as Ashwagandha, Triphala, Shilajit are selling D2C (directly to-consume) and even on the Q-Comm channels (quick trade), reaching the upper urban sections of the company.”

The Ayurvedic brands are those who use traditional principles and methods of Ayurveda, while natural brands add only a few naturals or herbs to their products. Dabur sales increased by 3% on an annual basis in 2024-25, Himalaya and Cholayil expanded by 7.5% respectively and 1.3%. However, Patanjali and Vicco sales decreased by 4% on an annual basis, affecting the overall growth of the segment, said Kantar.

“We took measures to guide the penetration of our health brands and expanding the state of necessity beyond immunity by entering new areas such as fighting stress, digestion etc.

He added that the company has continued to add new products and offer Ayurvedic centuries -old remedies in modern formats to better connect with millennial consumers.

Almost every family in India acquires at least one Ayurvedic brand. With Dabur who has the highest penetration (81%), followed by Patanjali (58%), according to Kantar.

However, Patanjali, due to his presence in many categories, dominates with a higher share of volume.