Salient points

- India should capture a 20% share of the global production production of smartphones in 2025, led by the demand for export by important companies such as Apple and Samsung.

- Investments in progress by global electronics production companies and an increase in local production capacities have significantly strengthened the position of India in the global production ecosystem.

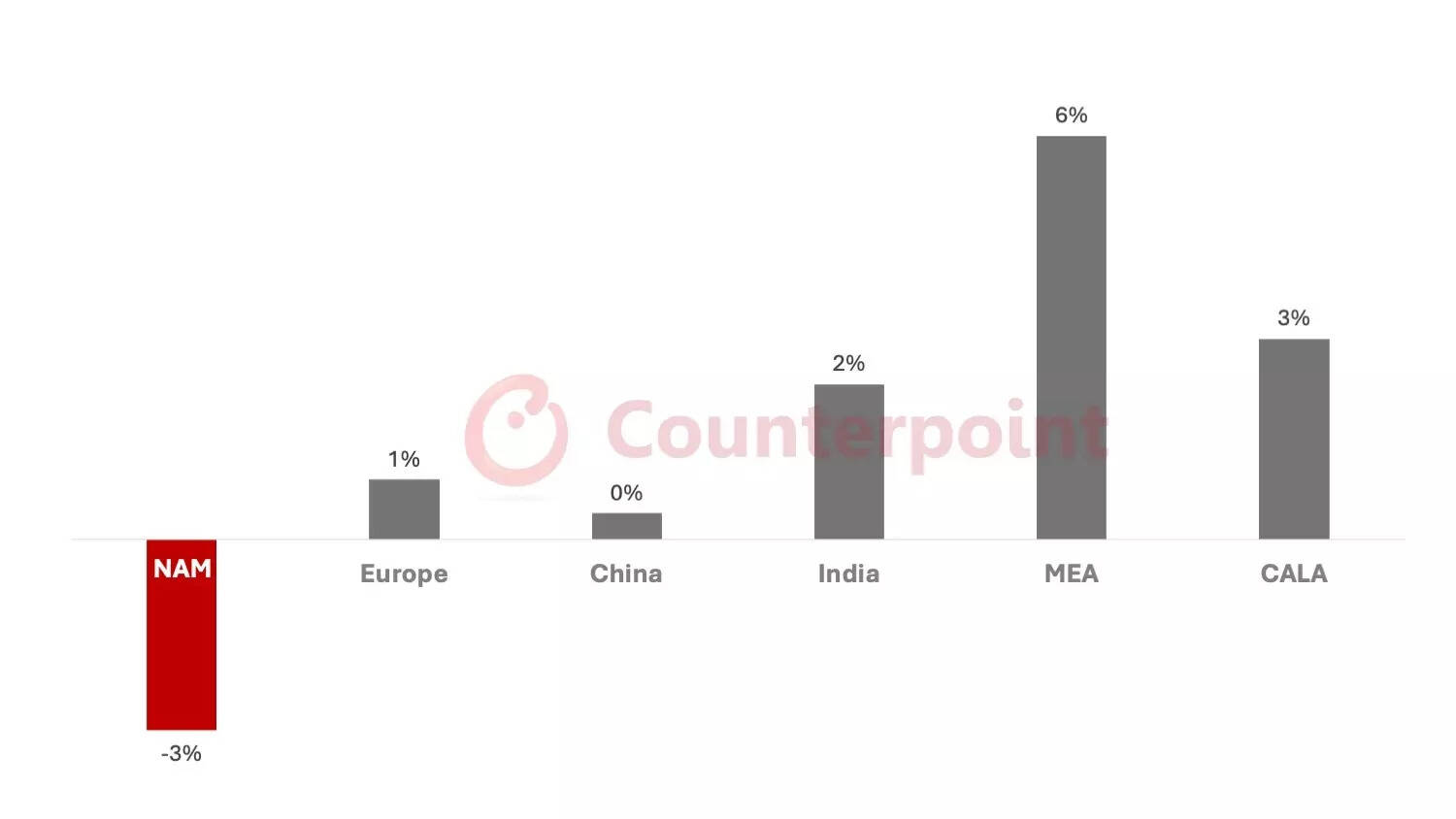

- Counterpoint Research has revised its expenses for shipments for global smartphones of 2025 up to 1.9% on an annual basis due to uncertainties that surround the rates of the United States, which have an impact on regions such as North America and China.

A 20% share of 20% of the global production of smartphone production in 2025 is expected, fueled by the export demand by Apple and Samsung and could be in crisis in the general market, said Counterpoint Research in a report published Tuesday. “India will be the great winner in 2025. The country should record a two -digit percentage growth during the year to capture a 20% share of global production,” said the research company, adding that Vietnam, also an export hub of global production, will also see a strong growth led by Samsung and Motorola.

Prachir Singh, a senior analyst of Counterpoint Research, said that the investments in progress by Global Electronics Manufacturing Services (EMS) companies and active participation by national companies have significantly improved the homemade production skills in India, making the country suitable to meet the major production requests.

“In the meantime, the general manufacturing ecosystem of India is constantly growing and local production is constantly improving, both in terms of surrender and complexity,” Singh said.The Donald Trump administration has imposed a basic rate of 10% on all countries, including India, with China also imposes mutual rates in the United States. In particular, the consumer electronics articles, including smartphones and laptops, remain free from the rates.

However, Trump threatened to impose a 25% rate on all smartphone brands, in particular by targeting the Apple iPhone and Samsung phones made outside the United States, unless they are manufactured in America, have recently reported the US media.

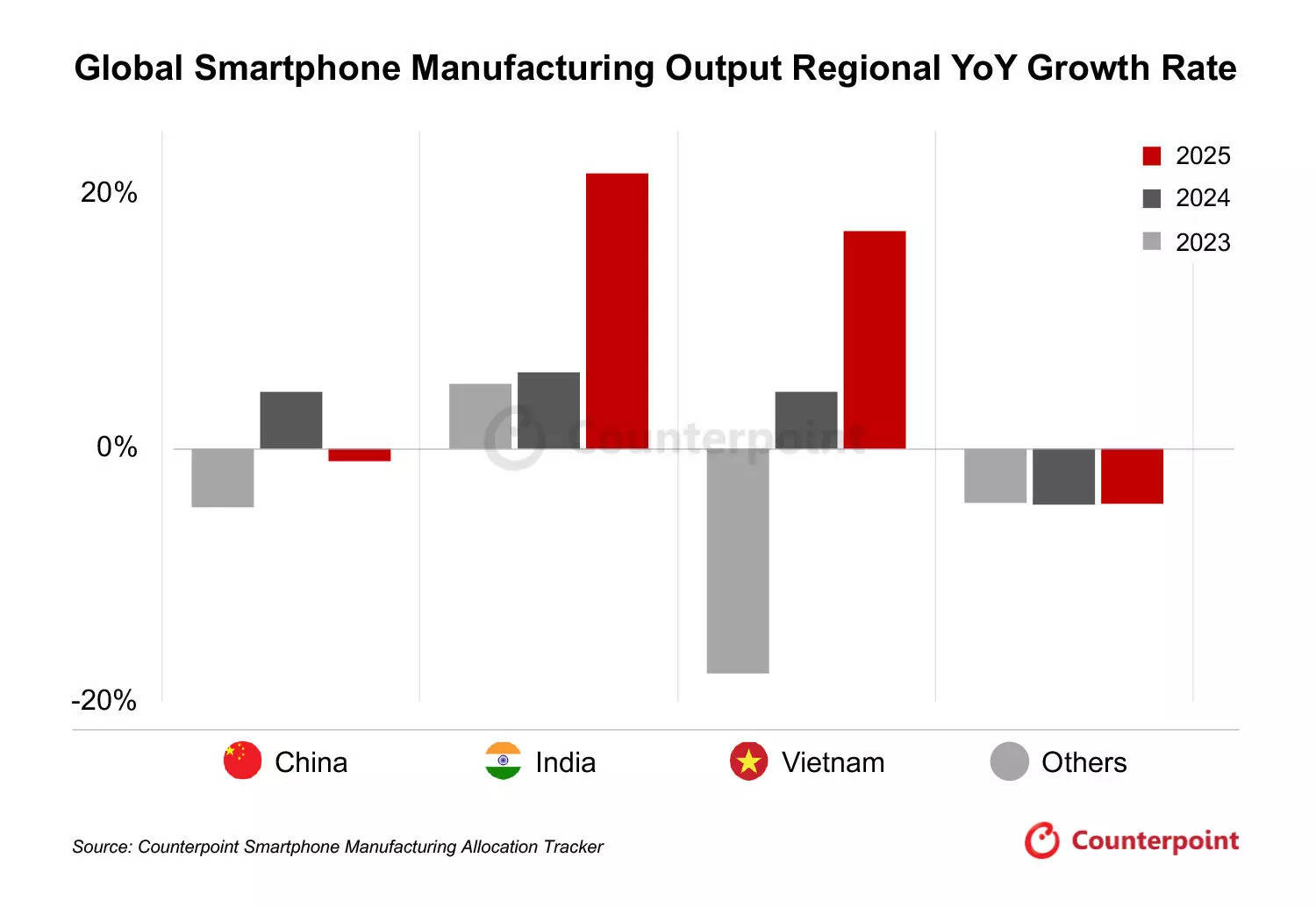

On a global level, the production of smartphone production should slide 1% on an annual basis in 2025 due to tariff impacts and a wider slowdown in the sector, following a 4% increase on an annual basis in 2024, according to the research of Counterpoint.

China, India and Vietnam were responsible for over 90% of global production production in 2024, with India in terms of growth. However, in 2025, the production results from different countries will be expected to show conflicting services.

China will feel the impact of rates in 2025, which will involve the decrease in production combined with the length of length of forecast.

The senior analyst of Counterpoint Research, Ivan Lam, said: “… The rates have damaged the actors in the sector at all levels – from suppliers of components upstream to importers and distributors downstream, brands to producers. Consequently, brands owners have no choice than to get out of China and allocate more productive and production capacity in other countries.”

Lam added that India and Vietnam should emerge as winners, with the latter region closest to China and with a manufacturing sector and export of mature contracts for consumer electronics.

‘If Apple has really produced an iPhone in an American factory, considering that everything is not yet underway, my estimate is that the price will increase by at least 15%-20%, that is, $ 150- $ 200. We believe that this increase in costs will mainly be due to the delta of labor costs, the cushioned capital of factories and logistics “.Neil Shah, vice -president of Counterpoint Research said.

The research company stressed that the changing supply chains requires an effort, a significant capital and a time and observed that China, India and Vietnam have used over 10 years to build and reach their current skills and skills.

Recently, the agency has revised the forecast of the growth of shipments for global smartphone of 2025 to 1.9% on an annual basis compared to the previous 4.2% on an annual basis, in light of the renewed uncertainties that surround the US rates. However, most of the regions will probably see growth, except North America and China.

Be First to Comment