Salient points

- Tata Motors has scheduled an investment of $ 33,000-35,000 in the passenger vehicle sector, including the division of electric vehicles in the next five years.

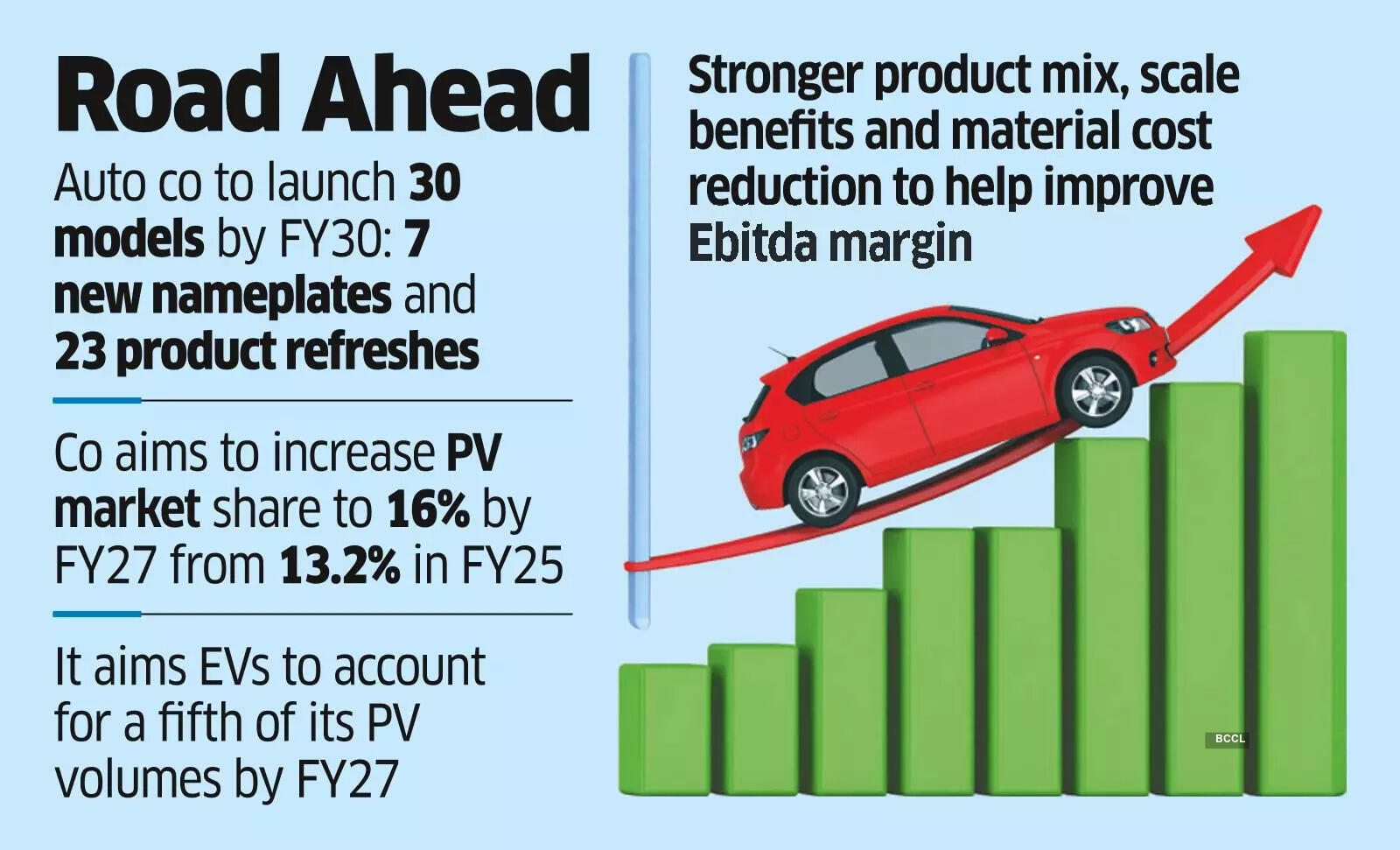

- The company aims to launch 30 models by the end of the decade, including seven completely new plates and 23 product updates, expanding its portfolio from eight models to over 15.

- Tata Motors plans to increase the market share of passenger vehicles to 16% from FY27 and 18-20% from exercise 30, waiting for electric vehicles to include 20% of the volumes of passenger vehicles from FY27.

Tata Motors has allocated an investment of $ 33,000-35,000 in the passenger vehicle sector (PV), including the electric vehicle arm, in the next five years, the company said in a presentation of Monday’s investors.The investment will go to the expansion of the products of the Tata company, integrating the next generation technologies and improving profitability. The Capex Plan includes £ 16,000-18,000 crosses specifically intended for the EV business between Fy25 and Fy30.

The producer of the Nexon and Safari SUV plans to launch 30 models by the end of the decade. This will include seven brand new plates and 23 product updates, expanding its portfolio from the current eight models to over 15 on more engines. These products will include fossil fuel vehicles, electric vehicles and platforms ready for the future, including one under the Sierra brand and two under its next range of EVinya, said the company in the presentation.

With the investment, Tata Motors aims to increase the market share of passenger vehicles to 16% of Fy27 and to expand it further to 18-20% of the fiscal year from 13.2% in exercise 25. The company provides that electric vehicles represent a fifth of its photovoltaic volumes for Fy27 and 30% from Fy30.The photovoltaic activity of Tata, which recorded revenue of 48,400 crores of £ 48,400 in the year25, will tire 6-8% of its annual turnover for capital expenses in the investment period. The company plans to improve its photovoltaic ebitda margin at over 10% FY30 from 6.9% in the year24, led by a stronger mix of products, benefits for the scale and reduction of the costs of the materials. The EV division became an operationally profitable in exercise 25, one year in front of its FY26 objective, benefiting from the high location, aggressive control of costs and incentives within the government incentive regime (PLI). The company has accumulated £ 250 crores in PLI25 benefits, compared to £ 102 in Fy24.

Tata Motors is about to decree its activities as photovolta and commercial vehicles in two listed entities. The renovated PV unit will host both the Tata PV activities and Jaguar Land Rover and will operate with the name of Passenger Vehicles Tata Motors. Demerger should be completed by the end of 2025.

Discover more from Gautam Kalal

Subscribe to get the latest posts sent to your email.

Be First to Comment