Et Intelligence Group: Bajaj Electricals’s stock has increased by 24% in a month after announcing the results of the quarter of March 2025, overlapping the drop of 1% of the durable index to the consumer et. The company includes a two -digit operating margin (EBIT margin) in the next three years, led by the premiumization of products and optimization of costs. He also incorporated a subsidiary in the United Arab Emirates to increase exports. Analysts reviewed Cagr revenues at 11.5% for FY25-27 from 9% previously.

The company provided a two -digit Ebit margin guide for the durable consumers segment in the next three years. For Fy26, it provides that the margin will improve 6% from 3.2% in exercise 25 In addition, the provision made by the company to manage the end -of -life phase of the products or the responsibility of the extensive producer (EPR) will probably double in the year 26 of the previous year. These factors can influence the trajectory of the margin.

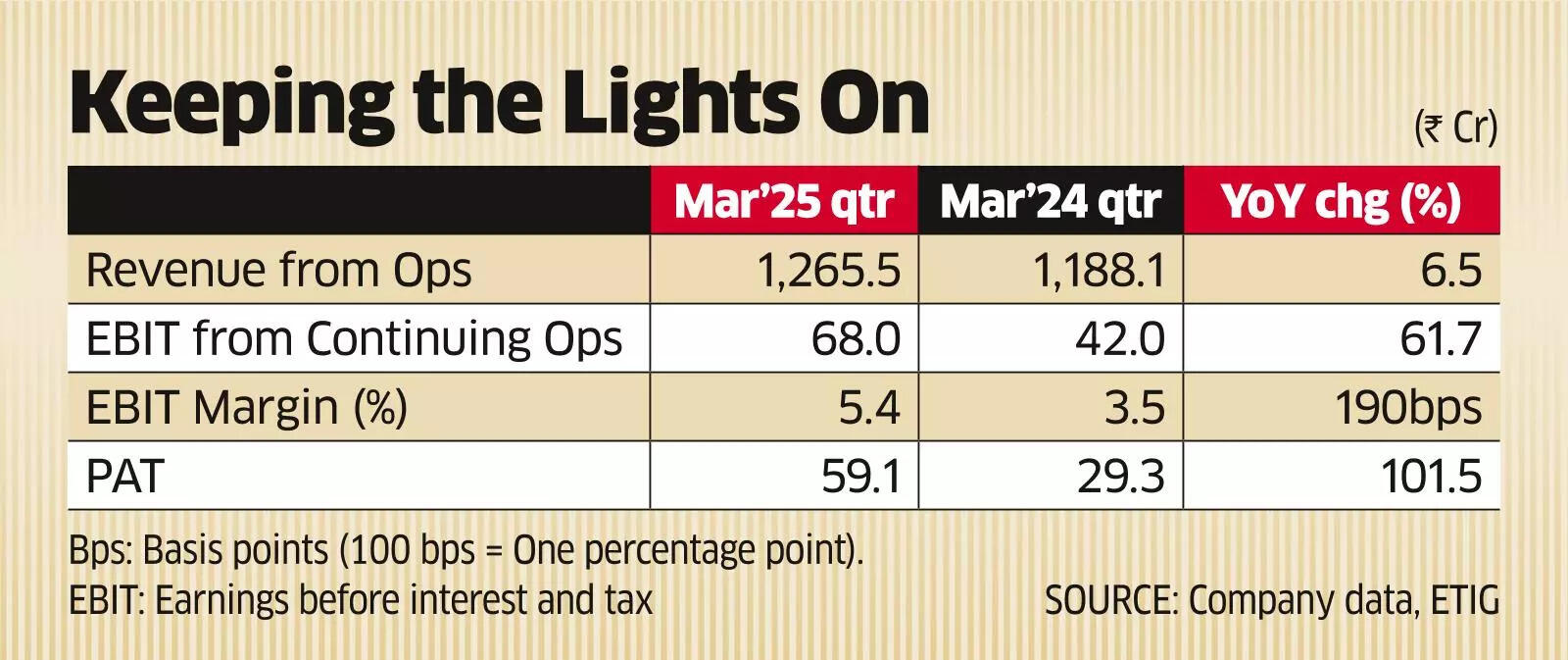

“The management is aimed at a 6% margin for consumer products, which we believe that it will be high by the highest A&P expenses and EPR provisions,” said the securities in a ratio. On an annual basis, the revenue of the operations grew by 6.5% to £ 1,265.5 cror in the quarter of March 2025, led by the growth of consumer products. The net profit increased by 101.5% to £ 59 crores, following the exceptional profit by £ 21.4 with the liquidation of few properties. The Ebit margins for consumer products improved 3.9% in the quarter of March 2025 by 1.8% in the quarter of the year. However, the lighting margin of the solutions was contracted to 7.8% from 8.5%. According to the management of the company, the lighting margin can improve as the erosion of prices in some of the categories in consumer lighting is behind and the prices have stabilized.

The company’s strategy to focus more on the premiumization of the product portfolio and on the launch of several products it may take a long time, according to Yes Securities. “The company will have to navigate on the challenges on the side of the kitchen appliances that is facing the pressure of the smallest regional players,” added the intermediation. He updated the actions to “neutral” from “Sell” after the drop in price and better profitability. The intermediation provides that the EBITDA and PAT of the company grow of 20% and 26% every year, between FY25-27 respectively.

Discover more from

Subscribe to get the latest posts sent to your email.

Be First to Comment