Amazon addresses leadership in all its activities, including 10 minutes delivery despite being the last great competitor in the flourishing rapid trade market in India.”The E -Commerce is still in advance and the rapid trade is part of it; it is only a faster delivery for us,” said Samir Kumar, Amazon India country manager in an interview. “I think there will be more winners, but at the same time, we are building it based on customers’ inputs.”

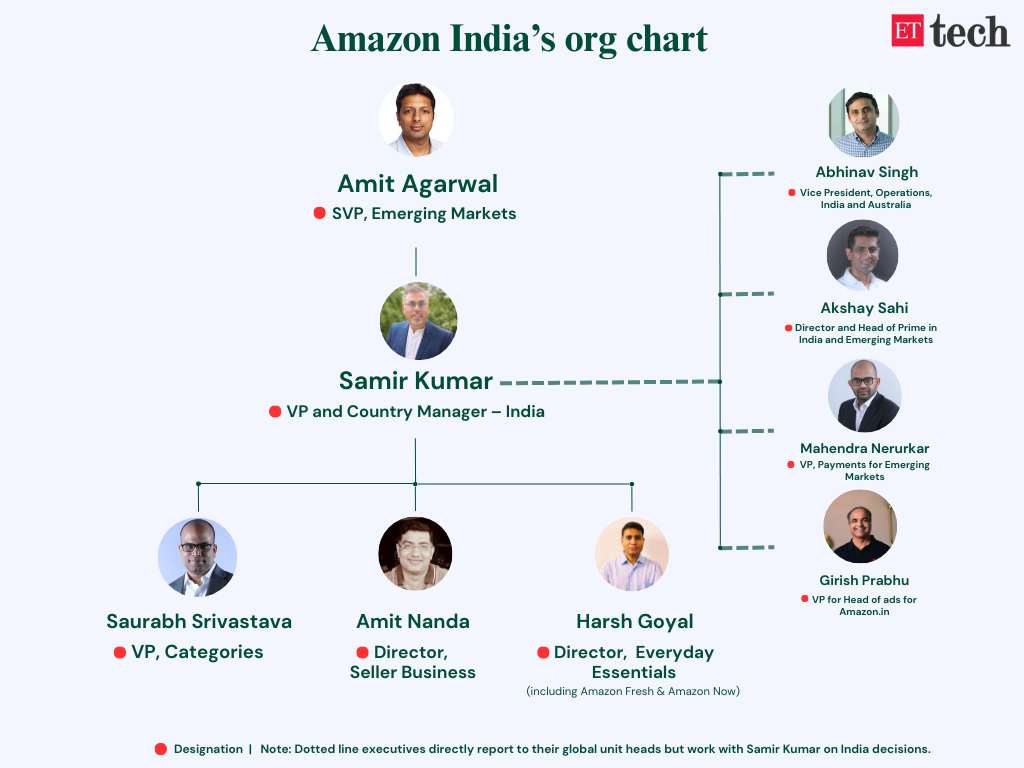

Kumar, who has been with Amazon since 1999, took charge of the business of India last October, replacing Manish Tiwary, who moved to Nestle India as CEO.

Amazon formally joined the instant deliveries market in June with the launch of Amazon now, starting with Bengaluru, before he began to expand to Delhi-Ncr. Kumar did not reveal the counting of dark or micro -ware stores that manages Amazon, but said the service already covers most of Bengaluru.And he had reported that Amazon now aims to create 300 dark shops on Delhi-Ncr, Mumbai and Bengaluru by the end of 2025. In comparison, the leader of the Blinkit market managed 1,544 dark shops as of June 30, while SWIGGY’s Instamart and Zepto had each more than 1,000.

The frenetic growth of rapid trade through the Metros has affected Amazon more, affirm the experts in the sector.

Kumar said that Amazon will not hold on to rapid trade investments, a segment that requires high burns to obtain market shares. “We will be very daring in terms of investment to get to that staircase. If we are entering now, on a large scale, we believe that we can make money by doing it,” he said.

“We do not target very small cities for rapid trade, since the question may not justify it. But everywhere the model works, we are confident of being able to build a sustainable business.”

Amazon and Flipkart’s entry has increased competition in a segment that has grown abruptly over the past three years. Flipkart launched his minutes in 2024 and said he will have 800 dark shops throughout India by the end of the year.

The intermediation company Jefferies said that the entry of Flipkart and Amazon into the rapid trade was “more out of strength” than the choice, with users and their portfolio share that quickly move towards quick trade platforms. “Quick trade has become mainstream and the entry of horizontal platforms such as Flipkart and Amazon is more out of strength, since users have quickly moved to these platforms,” said Jefferies in a June note.

The founder and CEO of the Swiggy group, Sriharsha Makety, also reported the growing intensity of the competition last month, stating that the rivalry is strong both from pure playing companies and by larger e-commerce platforms. While the former are recalibrating spends for their networks, the second is evaluating whether to go completely “fast” or simply “fast enough”.

Amazon, for his part, is positioning himself in the long term. Kumar said that the company’s goal is to reach the scale and from there building a leadership position through multiple delivery speeds. “A customer should be able to use the same app to buy fresh fruit in 15 minutes, a smartphone in one day and furniture in a week,” he said.

The year 2024 saw a moderate e-commerce growth to 10-12%, from the annual growth of 20-30% recorded only a few years ago, while consumers reduce discretionary expenditure. Horizontal players such as Flipkart and Amazon have also seen slowing the growth of the value of serious goods, both pushing to refine attention on profitability.

For the tax year, Amazon Seller Services, Amazon’s arm of the Indian market, recorded a 14% increase in operational revenues, while narrowing its net loss of 28%. The growth of revenues was greater than 3% recorded in exercise 23 but still followed the pandemic years when growth had increased by 32% in the tax year 22 and 49% in the year21. The company has not yet revealed its FY25 financials.

Kumar stressed that there is still a lot of space for the sector. “The E -Commerce is still scratching the surface. They are the first days. We are far from full penetration,” he said.

Strong festive sales

He highlighted the recent Amazon sales events as proof of the fact that the question remains strong if triggered. Prime Day this year was the largest of the company in India, with 18,000 orders per minute at the height, 50% more than last year. About 70% of the new privileged inscriptions during the sale came from smaller cities and 60-70% of small and medium-sized sellers on Amazon saw most of their orders from level II and Tier-III cities.

Amazon’s push to drive both the E -Commerce and the rapid trade are anchored in its great customer base and in the logistics network at national level.

Kumar said that with over 100 million customers in India, a growing subscriber base and a large -flow rate logistics chain, the company is positioned to win regardless of the delivery or speed format. The differentiation, he claimed, will come from the selection offered, the proposal for value and the depth of the Amazon supply chain.

“Continuing to concentrate beyond the best cities is important for the next 200 million customers, which is a key area for me,” he said, underlining this as one of the main priorities of Amazon India for investments in financial and human resources.

For now, the festive demand is providing momentum. The shopping season, once widespread in three months, has condensed into specific events such as Raksha Bandan, Independent Day and Janmashtami. And he reported how it is the platforms of E -Commerce and rapid trade are lengthening festive calendars to the juice question. Amazon is also leaning on firsts like a flywheel, offering more level subscriptions such as first quarrels and first shopping edition to increase adoption.

Be First to Comment